BioJapan, five years in – why we keep going back

MedCity is leading the UK Delegation to BioJapan for the fifth consecutive year, in what has become one of our largest annual outward trade missions. Here we share more about what is set to be one of the most ambitious trips yet, and why we keep on going back.

We’re a relatively small team here at MedCity and like any organisation with a not infinite arsenal of resources, we have to carefully select where we invest our time. And as anyone that has organised a major international trade mission will tell you, it’s an undertaking that will inevitably leave you just a little anxious and a lot sleep deprived. Why then have we not taken a proverbial fallow year for BioJapan over the last half decade?

Well the truth is, not only are we not taking a year off, we’ve lined up an even more ambitious schedule than ever before. And we’re not just talking tackling those over-excited world cup Rugby fans for hotel rooms!

Why Japan?

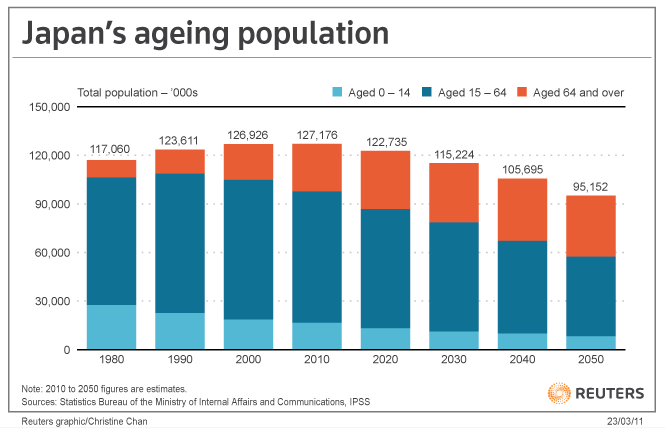

There are no signs of Japanese interest in the UK life sciences market diminishing, in fact the opposite is happening. Pressures on the Japanese domestic market are refocusing companies outwards and a declining population, along with ministerial decisions on reimbursement favouring generic replacement, are spurring continued externalisation.

- The Japanese pharma market is ranked 2nd in the world

- Japan leads the world in advanced therapies such as immuno-therapies, aided in part by legislative changes in 2013 allowing conditional market access with oversight after completion of phase 2 trials

- It’s a highly diverse market, comprised of traditionally domestically focused companies, often family formed, alongside highly globalised players

- Major Japanese companies including Shionogi, Daichi and Takeda are well established in the US and UK markets

- A new layer of companies are now slowly opening to international engagement, such as ONO, Otsuka Astellas and Ajinomoto (a former food manufacturer)

- The Japanese market, as elsewhere is going through a profound period of industrial convergence. Traditional auto and related companies are increasingly investing both in medtech and the digital area of healthcare. Mitsubishi Research has a major surgical and medtech division, and Honda themselves are rapidly moving into surgical and biosensors

The UK and Japan – natural synergies

- Oncology and all aspects of neuro-degenerative disease are of dominant interest for Japan – and as one of the world leaders in these fields, the UK is an excellent potential partner

- Another area of significant interest for the UK and a big focus in Japan is its rapidly ageing population, meaning technologies and solutions that address the advance in home diagnostics, treatment and care are highly valued

The 2019 Delegation

This year, we’re delighted to have a diverse delegation of 22 organisations joining us from around the UK, including fellow cluster organisations the NHSA, representing the north of the UK and HIRANI, representing Northern Ireland. It’s also an extra special year for the UK, with Paul Workman, CEO of the Institute of Cancer Research delivering the key note speech at the opening of BioJapan itself.

We’re also aiming to get the absolute most out of the delegation visit this year, with a herculean level agenda in place. We’ll be visiting life science hubs not just in Yokohama, but also in Kobe, Tokyo and finally Seoul in South Korea before heading back to UK.

- 7 October – Kobe Biomedical Innovation Cluster Symposium, Kobe

- 8 October – UK Life Sciences Symposium and Link-J Global Life Sciences Session, Tokyo

- 9- 11 October- BioJapan 2019, Yokohama

- Mon 14 October – KHIDI Symposium Seoul (am); KPBMA Symposium Seoul (pm), South Korea

We’ll be blogging and sharing details of the trip on social media using #UKatBioJapan and #BioJapan, so please follow our travels and let us know if you have any questions along the way!