The outlook for investment into UK life sciences

What is the outlook for investment into UK life sciences in 2023 and beyond? What are the opportunities and challenges that investors are identifying in the current economic and political climate? These are some of the questions we are addressing at the UK Life Sciences Investment Summit being held on Tuesday 14 March at The Francis Crick Institute in London.

MedCity is joining forces with the Northern Health Science Alliance (NHSA) to deliver the event, which brings together life science investors and drivers of innovation from across the UK as part of a Research England-funded project to demonstrate how cross-cluster working can catalyse investment opportunities.

The Summit comes at a significant time in UK life sciences. After strong growth, the sector has been facing economic headwinds and the prospect of policy changes that may prove pivotal. Aside from the recurring conversation on losing future UK unicorns to Nasdaq or merger and acquisition activity, the Summit provides a platform for exploring more nuanced aspects of the investment landscape.

It will be an important opportunity for investors to:

- Meet other life science investors and sector specialists from across the UK

- Understand strategic NHS priorities and public sector investments

- Learn how the NHS looks at innovation and adoption to inform future investment decisions and to support portfolio companies

As well as networking opportunities throughout the day, four panel discussions will uncover insights on investor and NHS perspectives, increasing investment in underrepresented founders, and the role of UK health and life sciences clusters.

We are delighted to have Barbara Domayne-Hayman, entrepreneur in residence at The Francis Crick Institute, delivering the keynote speech, drawing on her vast experience driving collaboration in life sciences:

“My talk will address some of the various gaps that exist in the early-stage investment landscape, which we are trying to tackle at the Crick, breaking down barriers through collaboration. I will also focus on a very particular funding gap that creates challenges for early-stage data driven health start-ups, operating at the interface between data and biomedical science, which catalysed the creation of the KQ Labs accelerator, a programme run by the Crick and funded by LifeArc.”

Barbara Domayne-Hayman, KQ Labs Chair & Entrepreneur in Residence, The Francis Crick Institute

Each of our four panels will tackle a different theme, reflecting sector directions, and bringing together an influential cast of life sciences investment stakeholders.

Panel one: Investor Perspective on the UK Life Sciences Sector

Chair Jenny Tooth OBE (Executive Chair, UKBAA) will be joined by investors from leading investment firms and networks.

The panel will share their perspectives on trends and developments for the sector, and how these may affect investment decisions. They’ll be sharing insights on what investors are looking for right now, and what advice they’re giving to their portfolio companies. And they’ll be discussing how all parts of the ecosystem can work more closely with investors to deliver value.

“Our panellists represent the breadth of the investment life cycle, from angel investors to VCs and growth capital. With access to risk capital so vital to the continuing success of the life sciences sector, and against the backdrop of the current economic climate, I am looking forward to gaining their insights on the current challenges and what opportunities they are identifying to increase investment in the sector. We will also look at the policy environment, regional and international capacity and what further actions can be taken to improve the ecosystem for life sciences investment here in the UK.”

Jenny Tooth, OBE, Executive Chair, UKBAA

Panel two: Innovating within the NHS

Chair Dr Kath Mackay (NHSA board member and Director of life sciences, Bruntwood SciTech) will be joined by a panel with deep experience of NHS adoption of innovations.

The panel will share their experiences of how to smooth the adoption pathway of innovations in the NHS, and how investors and other stakeholders can play a role in this.

“In an ever more resource-constrained environment, it remains important that a culture of innovation is seeded and supported within the NHS to improve patient outcomes. Partnership working with the NHS provides a huge opportunity to grow and scale investable businesses in the UK whilst getting innovations to patients faster.”

Dr Kath Mackay, NHSA Non-executive board member, Director of life sciences, Bruntwood SciTech

Panel three: Increasing Investment in Underrepresented Founders

Chair Kate Rowley (experienced executive and investor and General Partner of Global Biofund) will be joined by a panel with passion and experience of investment in underrepresented founders.

The panel will discuss challenges for underrepresented founders – for example, according to Crunchbase, companies with female founders raised just 2.2% of all venture funding in 2021. They will share their insights on what is being done, and what needs to be done, to address diversity in investment portfolios.

“It’s a challenging time for investment, with many investment managers and VCs concentrating on their existing portfolio. This makes it harder for non-traditional approaches to attract funding. However, we should look to innovate in investment and seek to improve on existing methods, rather than rely on – what some may perceive to be – traditional approaches.”

Kate Rowley, General Partner, Global Biofund

Panel four: The Role of UK Health & Life Sciences Clusters in Facilitating Trade and Investment

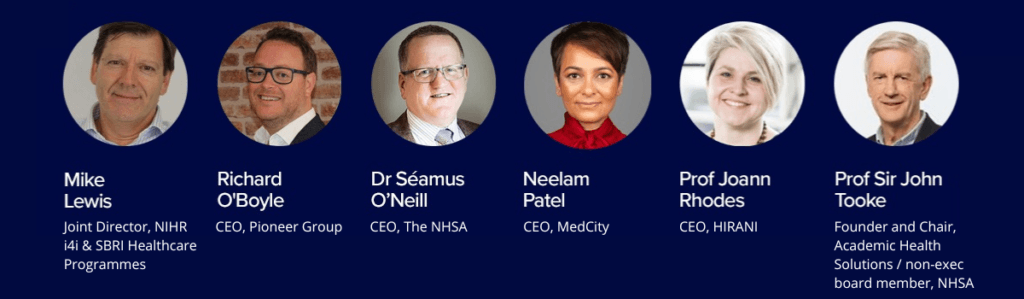

Chair Sir John Tooke (Founder and Chair of Academic Health Solutions, and Non-exec Board Member of NHSA) will be joined by a panel of leaders from life sciences clusters across the UK.

We will hear from clusters representing London and the South East, the North of England, The Midlands of England and Northern Ireland. This will include an overview of regional developments, as well as how clusters can work together to build partnerships and facilitate trade and investment for the UK as a whole.

“It is well recognised that interinstitutional and intersectoral collaboration stimulate high impact research but in times of financial constraint these essential facilitatory mechanisms can be neglected. Investment in cluster collaborative links is even more important to enhance the pace and productivity of medical innovation in such testing times.”

Sir John Tooke, Founder and Chair of Academic Health Solutions and Non-exec board member of NHSA

For updates on the Summit and the key takeaways from our expert panels, be sure to follow our LinkedIn and Twitter channels.

Find out more

Tickets for the UK Life Sciences Summit are no longer available but we will be reporting on the panel discussions post-event. In the meantime you can find out more about the Summit here and here.

If you are an investor and would like to participate in future events please get in touch: