Pre-screened and pitch-ready: introducing our next Investment Hub cohort

In February, MedCity’s Investment Hub will be hosting a virtual pitch event with five early-stage companies presenting their business models and products to a select group of investors. Each company can demonstrate technology with a direct or indirect impact on patients, and has been scrutinized by the Investment Hub’s panel of veteran life science investors and commercialisation experts.

Sarah Bruce-White, our Partnerships and Programmes Lead who runs the Hub, talks us through how the screening process works for prospective investment targets, and introduces the five companies taking part in February’s event.

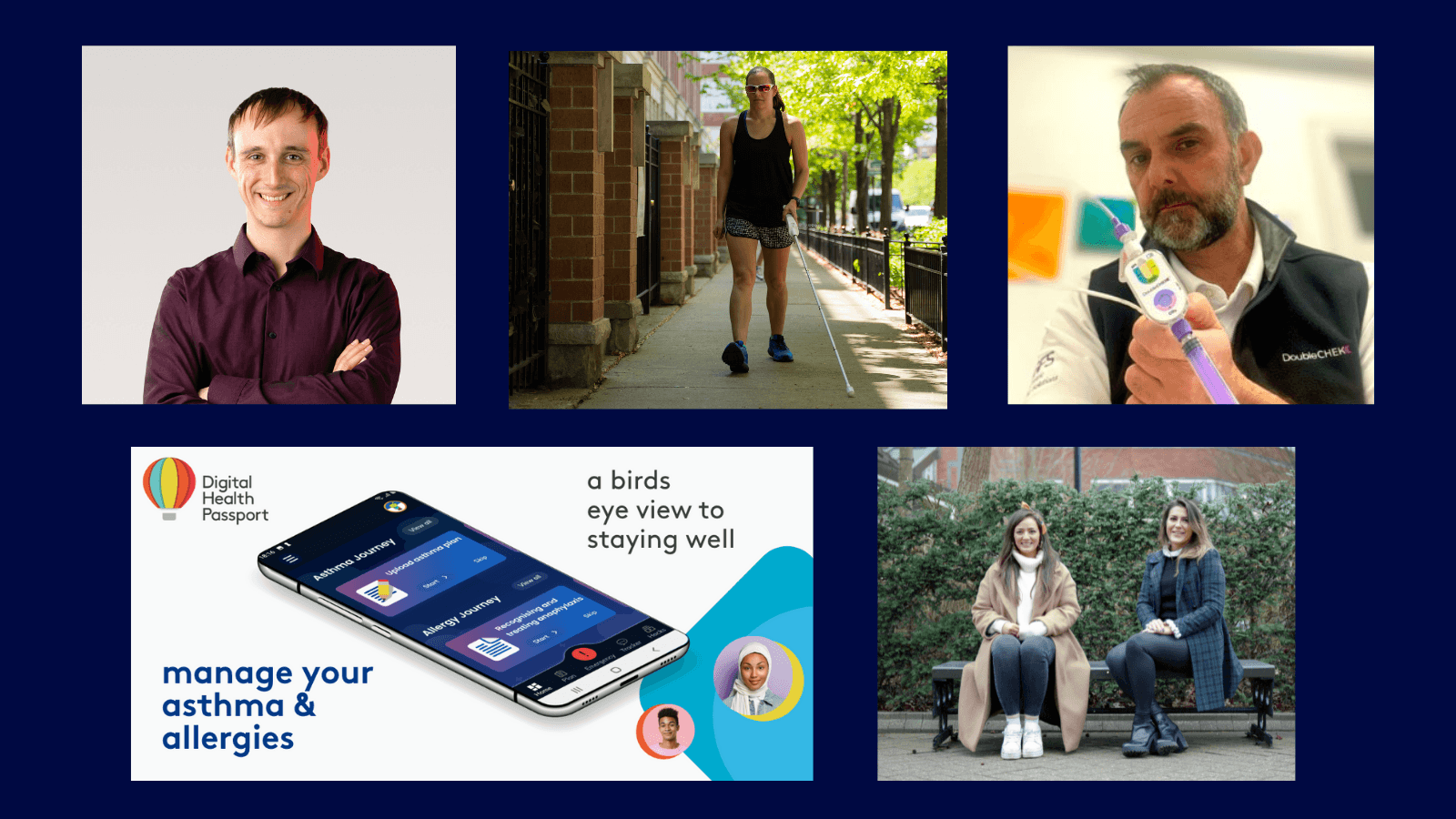

Pitching company images above, clockwise from top left: George Frodsham, founder of MediSieve; a WeWalk user; George Gallagher, CEO, Enteral Access Technologies; Stephanie Monty, CEO and Founder of Ostique and Toni Schneider, COO; Tiny Medical Apps’ Digital Health Passport®

What does the investment hub screening process look like, and how are companies chosen?

There’s quite a lot involved in the initial screening process. We look for some key things in the pitch decks: An innovative product and size of market opportunity, a solid founding team, the go to market strategy and their capability to deliver on it. We also look at IP, the evidence and traction generated so far and “fundability” — i.e. is their business model attractive with realistic projections, have the companies already received some grant funding and reached certain early-stage milestones?

Following the pre-selection process, applicants are reviewed on a dedicated platform against strict criteria by the wider Investment steering committee. The criteria assesses the team, the technology, the investment opportunity & innovation value amongst other things. For the companies that meet the criteria, we run an investment readiness pitch day, which matches some of our investors with the companies to gain solid advice and help them gain further exposure. We aim to present de-risked opportunities at our events so investors can be confident the companies presented for have already been through a robust selection process*.

Our five companies for February were chosen because they meet the selection criteria. Ostique, a female led medtech, meets an unmet worldwide need in ostomy products (used after surgery to allow waste or urine to leave the body). MediSieve’s magnetic blood filtration is a revolutionary platform therapy enabling removal of specific substances from the bloodstream. WeWalk is a smartphone-based navigation solution that is revolutionising visually imparied mobility. Tiny Medical Apps is keeping young people out of hospital by suporting self-management for asthma and gaining traction throughout the NHS. Enteral Access Technologies is focused on developing cutting-edge technologies for placing feeding and decompression tubes safely and quickly in any environment. Already CE marked, sold throughout the UK & revenue generating.

*Please note we take no responsibility for due diligence which is the responsibility of the investors themselves

Ostique

Ostique is a female-led medtech with a vision to provide personalised healthcare management for all those with stigmatising medical conditions — by engineering superior medical devices and delivering AI-driven solutions that address users’ unmet needs

Ostique’s revolutionary ostomy devices aim to disrupt the £50 billion ostomy market where the lifetime value of each of customer is over £50,000. Ostique has developed patented technology to provide superior product functionality and novel personalisation processes to create customisable ostomy products..

Ostique also provides AI and machine learning driven solutions to provide a range of services centred around personalised healthcare that support users’ self-management. Benefitting from a recurring revenue model (Over £=1 billion ostomy products are used annually) Ostique is a high retention annuity business. Their novel products and services combined with direct patient relationships, give them a major competitive edge. Pre-revenue and raising up to £2M, they are EIS eligible.

MediSieve

MediSieve is a London biotech start-up developing Magnetic Haemofiltration, a revolutionary platform therapy that enables the physical removal of specific substances from the bloodstream of patients. It can be used (1) as a direct treatment, (2) to increase the safety and efficacy of other therapies, or (3) to enable personalised medicine. A unique, lifesaving and often cost-saving solution, there are several multi-billion-dollar markets available for this product in oncology, infectious diseases, auto-immune diseases, poisoning, drug overdose and others. Magnetic Haemofiltration has already been shown to rapidly, specifically, and effectively remova IL-6 from human plasma.

The technology has completed pre-clinical validation, including animal studies, and is expected to start clinical studies in Q2 2022. MediSieve has raised £4M in equity funding and over £4M in non-dilutive grants. Seeking a further £8M at Series A to support pivotal clinical trials and regulatory approvals. EIS eligible.

WeWALK

A Time magazine Best Invention, WeWALK is a smartphone-based navigation solution revolutionising visually impaired and elderly mobility. 253 million visually impaired people rely on primitive tools such as the white cane to get around, leaving them behind in today’s cities. WeWALK gets visually impaired people from A to B safely, effectively, and independently.

WeWALK attaches on top of any white cane, providing upper-body obstacle detection and intuitive control of our custom-built WeWALK app. As a result, users benefit from truly accessible multimodal wayfinding in over 3,000 cities, continually expanding through grant-funded partnerships with Microsoft, Imperial College London, and the RNIB.

WeWALK’s hardware and software subscription sell via B2B and B2C channels in over 59 countries with a $17.5 billion total addressable market. As an Amazon Startup of the year, WeWALK has already changed the lives of thousands while generating over $1.4 million in revenue. WeWALK is now pre-series A, fundraising $3 million to skyrocket growth and promote visually impaired & elderly equality. EIS Eligible

Enteral Access Technologies

Enteral Access Technologies (E.A.T.) is a Liverpool-based SME focused on developing cutting edge enteral access technologies designed to assist the clinicians who use them, and to benefit the patients that require them to in their fight to survive life threatening conditions.

An ISO 13485 certified medical device developer and manufacturer, with both the UKCA and CE marks, and a position on the NHS framework, E.A.T. is uniquely positioned to capitalize on DoubleCHEK™, their first product, which will be be rolled out over the next two years. DoubleCHEK’s patented technology will change the NHS ‘Never Event’ landscape for the persistent misplacement of nasogastric tubes (NGTs) and offer a level of confidence and safety not available currently. Seeking £2M in a Series A round. EIS eligible

The company was established in 2014 and after several years of R&D, started trading in 2020. E.A.T. is currently generating revenue in the UK and will launch in the US when its FDA application is approved

Tiny Medical Apps

Tiny Medical Apps (TMA) are keeping young people out of hospital by supporting self-management with their Digital Health Passport®.

Founded by an NHS emergency doctor and an NHS developer, TMA has developed the highest independently rated asthma app in the UK (ORCHA 89%) and secured a national funding deal with NHSX. The DHP will be used across all 42 Integrated Care Systems.

Childhood asthma is a priority area for the NHS, with mandatory deliverables for ICS commissioners that are addressed by the Digital Health Passport®. By improving skills, education and the confidence to self-manage, the NHS can reduce A&E attendances by up to 38%. This applies not only to asthma, but to all long-term conditions.

Having succeeded in getting a national foothold, TMA is now positioned to expand the platform to other conditions, and provide deeper integration into clinical pathways. TMA’s export potential has been recognised by the Dept for International Trade as part of #beyond100. EIS eligible and seeking £500k

Find out more

For Life sciences investors who are interested in attending the investment hub pitch event, please sign up via EventBrite.

Investors can find out more about this and other upcoming pitch events by emailing sarahbrucewhite@medcityhq.com

ABOUT SARAH BRUCE-WHITE

Sarah is MedCity’s Partnerships & Programme’s Lead, driving Investment activities, connecting entrepreneurs with investors, nurturing SME growth through mentoring and helping early-stage companies get investment ready. Sarah has many years commercial experience in launching start up medical device companies in the UK & internationally and bringing new products to market.